84% faster intake • 2.2x referral capture • $225K committed ARR

The operating system for healthcare's next $4.45B frontier

Mobile wound care is exploding as 73 million boomers age at home. But providers are drowning in disconnected systems built for hospitals. Medipyxis is their unified profit engine.

Why wound care. Why mobile. Why now.

Hospital beds are full. Medicare pays more for home visits. And chronic wounds affect 8.2 million Americans—growing 9% annually as diabetes rates soar. Yet mobile providers still run their $4.45B market on fax machines and Excel.

The Timing:

CMS increased home visit reimbursements 19% (2024)

Hospital systems mandating 48-hour discharge

Private equity consolidating fragmented providers

Workforce demanding mobile-first tools

$678 B

Total in‑home healthcare TAM

$67 B

Chronic wound care segment

$4.45B

High-margin mobile wound care (our beachhead)

$445M

Serviceable obtainable market (10% capture)

The Problem

Today's broken reality costs millions

Lost Revenue Epidemic

Manual intake hemorrhages profit. Clinics lose 1 in 4 referrals to fax chaos and phone tag. That's $312K in annual revenue vanishing into coordination failures—per location.

Tissue Graft Disasters

Documentation errors waste $90K annually. One missing photo or wrong code denies a $3,000 claim. Multiply by 30 grafts. That's real money lost to preventable mistakes.

Flying Blind

With zero operational visibility, CEOs discover problems months later—through bankruptcy attorneys. No dashboards. No KPIs. Just spreadsheet archaeology.

Growth Ceiling

Scale requires exponential overhead. Adding clinicians means adding coordinators, schedulers, and billers at a 3:1 ratio. Margin erosion guaranteed.

Medipyxis eliminates this chaos with six integrated modules:

Intelligent Intake

Turns fax chaos into 10-minute patient onboarding with OCR + AI routing

Compliant Clinical

LCD Navigator™ blocks non-billable visits before they happen—cutting denials by up to 81%

Inventory Intelligence

Real-time graft tracking can prevent $1,200+ product waste per expired lot

Revenue Optimization

Pre-validated claims reduce billing prep time by up to 90%

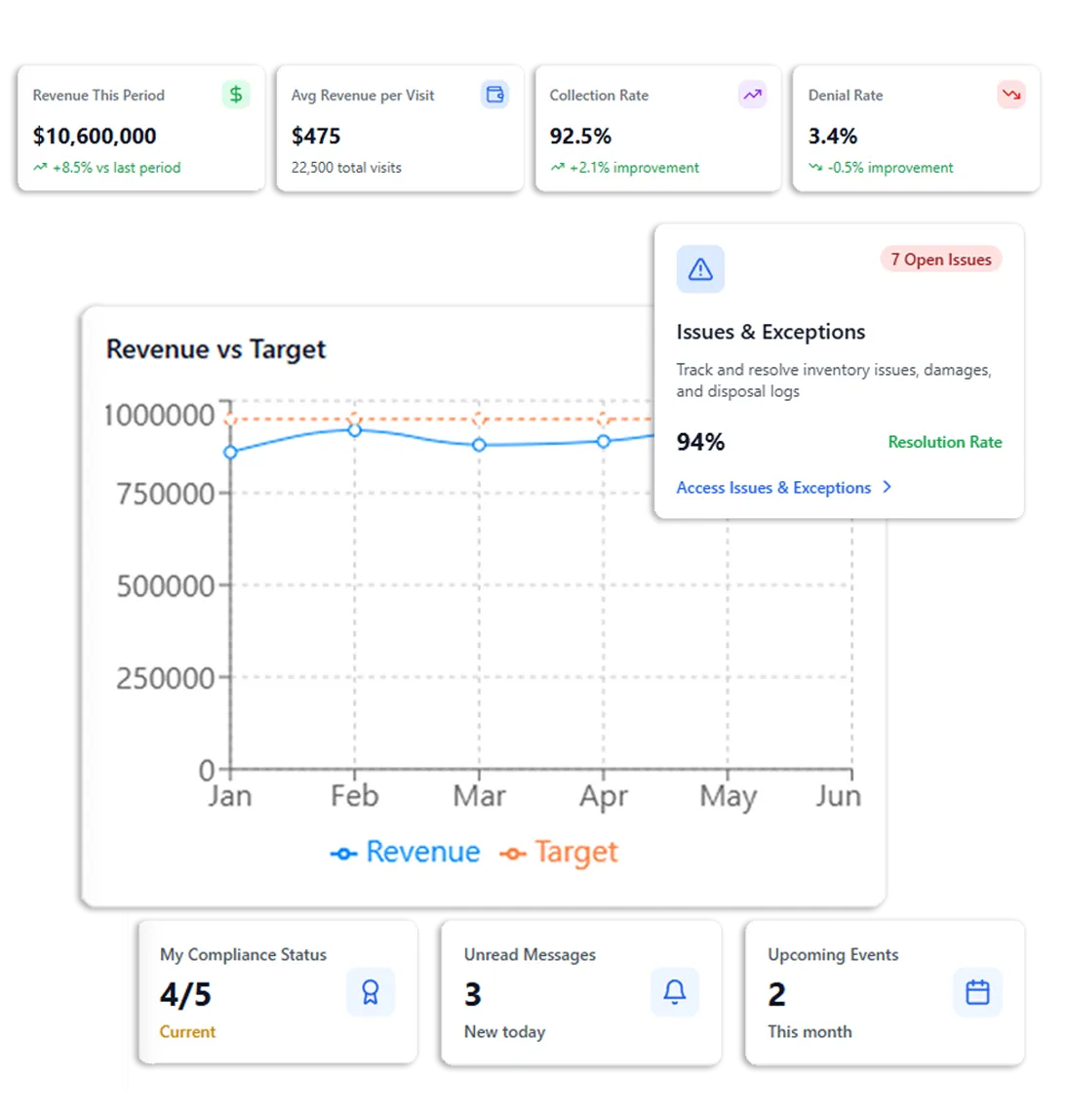

Operational Command

Live KPIs replace executive spreadsheet fire drills

Growth Accelerator

ROI-tracked referral outreach—see which $50 lunch generates $25K in visits

Why we win where $40B+ EHR giants fail:

✓ Mobile-native architecture (field clinicians work offline in rural homes)

✓End-to-end workflow automation (not just documentation storage)

✓Financial transparency (ties every clinical action to revenue impact)

✓Built for scale (one platform handles 10 or 1,000 clinicians seamlessly)

The transformation can be immediate: Practices see 60% faster intake, balanced provider workloads, and dramatically few lost referrals within 30 days. We're not improving wound care operations—we're rebuilding them from the ground up for the mobile-first future.

Want to Know More?

Join us on one of our webinars where we walk you through the most common struggles in the mobile wound care industry and how Medipyxis will transform the space.

Traction & Validation

Customer Proof

$2.5K MRR achieved before product completion

84% faster referral processing (18 → 3 minutes)

2.2x increase in daily referral capture

9 clinics on signed waitlist

Market Validation

3 LOIs totaling $225K ARR

$1.2M in qualified pipeline

100% retention of pilot customers

68 NPS score from early users

At a glance

Why Invest Now

Market Timing

✓ Regulatory tailwinds — CMS pushing value-based care

✓ Technology inflection — AI/OCR finally healthcare-ready

✓ Buyer urgency — Labor shortage forcing automation

Competitive Moat

✓ First-mover in category — No direct competitors in this segment

✓ Deep domain expertise — Founder operated clinics for 15 years

✓ Network effects — Each clinic improves AI for all

Exit Potential

Recent comparables:

- WoundExpert → Net Health ($100M)

- Tissue Analytics → $100M acquisition

- Healogics → $2.3B valuation

Conservative exit scenarios:

- 3x revenue multiple → $100M+ exit at $35M ARR

- Strategic acquisition by Tebra, Doximity, or ModMed

- PE rollup into larger home health platform

After 20 years in healthcare, I kept hearing the same complaints—fragmented systems pulling practitioners away from patient care. We built Medipyxis based on what they told us was broken. Our mobile wound care platform handles referrals to billing, eliminating administrative headaches so practitioners can focus on healing patients.

Damon Ebanks

- Founder

Join us: The opportunity to define a category

We're not building another feature in someone else's platform. We're creating the operating system that will power the future of mobile wound care—and eventually, all mobile specialty care.

The market is massive. The timing is perfect. The team has done this before.

Ready to transform how 30,000 clinics deliver care?

Stop managing chaos. Start healing patients.

A unified platform purpose-built for mobile wound care teams.